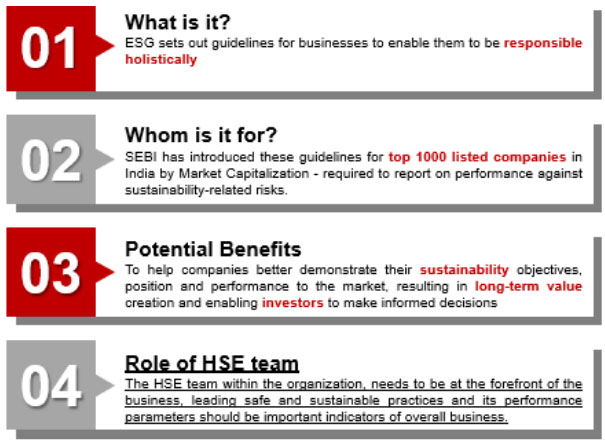

This article discusses the changing business scenario in India with respect to Environment, Sustainability & Governance (ESG) and how can companies have a smooth transition with these amendments coming into effect in the near future.

Companies need to grab this opportunity to imbibe sustainability into their DNA, else it will always be a catch-up game against frequently changing regulations

What is BRSR?

Sustainability is no longer simply a buzzword in today’s world and is picking up traction more quickly in India than we ever anticipated. This time, it’s not only the consumers and the government who are involved but also the market regulator SEBI, pushing this agenda, with a new norm mandating the top 1000 listed companies by market capitalization to make certain disclosures through Business Responsibility & Sustainability Reporting (BRSR), from 1st April, 2022 onwards.

The guideline mandates disclosures, covering three aspects related to sustainability:

- Environment: Requires companies to disclose details on resource use like energy and water, levels of emissions in air, water and soil including greenhouse gases, waste generation and its management practices and impact on bio-diversity

- Social: This will involve disclosures on the welfare of all stakeholders including employees and inclusivity in terms of employment and opportunity, taking care of the community and managing consumers and providing a transparent complaint resolution mechanism

- Governance: It will be imperative for companies to report their performance on ethical business practices and making the board responsible for corporate governance, maintaining transparency and accountability.

The BRSR norms encapsulate all the major global developments in the sustainability front – UNGP for Business and Human Rights, UN SDG, the Paris Agreement and convention on child labour by ILO along with an extension of the already set guidelines by Indian regulators like Annual Business Responsibility Reporting (ABRR) and the Companies’ Act 2013, which had made CSR activities mandatory for organizations beyond a certain size. It was an imperative for Indian regulators to expedite their actions since funds from Indian companies contribute to only a miniscule 0.05% of global sustainability assets.

What implications does this have for businesses?

BRSR reporting format eliminates qualitative data reporting and welcomes quantitative data reporting, providing a performance measurement metric for investors. The law mandates annual reporting on these metrics for all concerned companies. But some industries that function on cyclical basis might be required to report the parameters annually on a ‘per project cycle’ unit. These actions highlight that businesses are not only accountable to shareholders but also to the community, consumers, business partners and employees. The law will undoubtedly strengthen the position of India on the sustainability fronts.

It’s also noteworthy that the ESG norms are amenable to the requirements of each industry, which essentially indicates that performance measures will be a peer-to-peer comparison, with a performance threshold in place. Hence, a poor performer might not be able to escape by comparing its performance against another company from a different industry which has higher allowances.

Pursuits by companies to become sustainability champions can have implications for the suppliers, channel partners and customers. Smaller suppliers and MSMEs, even if they are not within the top 1000 listed companies, will need to comply with the law if their customers mandate them to. Distributors and dealers need to strictly abide by the company’s guidelines in order to avoid penalties related to ESG. Consumers will also need to take up a bit of the responsibility and bear the extra costs of these efforts.

An important spinoff benefit of these norms is that it has brought several retail investors into play through Socially Responsible Investments (SRI), a type of fund that operates with sustainability metrics as its prime measure of performance. In 2019, India had only two such funds, which has now increased to ten, as a consequence of the strong performance of these pioneer funds over the past couple of years. As the retail investors are getting involved in sustainability and governance activities, its awareness is expected to grow manifold. The consciousness is also spreading onto the consumers and making them better informed about mindful purchases. Such developments can have serious adverse consequences on the financial performance of companies that do not live up to the expectations of their stakeholders on ESG.

Smart organizations will grab this opportunity to move ahead and create a competitive advantage by inculcating sustainable development in its true spirit while others will be forced to follow certain norms of sustainability. What leaders can do is innovate in this field, break the clutter and stay ahead as the torchbearers for the industry.

How can companies prepare themselves?

The BRSR guidelines, 2019 are just modifications of the BRR norms, 2012 and ramifications of the international commitments of India towards these issues. Yet, responsibility towards the Environment and Sustainability are still very nascent concepts, even if we consider that we have made some good progress in Governance. Thus, it would be wise to expect further modifications to the BRSR, 2019 guidelines and a prudent approach for the companies will be to stay better prepared for stricter compliance guidelines with respect to ESG.

A simple way to be ready for any changes in laws related to ESG will be to imbibe the culture of sustainability, responsibility and accountability towards the environment, society and governance. It is not easy to develop such a culture within an organization overnight or do away with deep-rooted existing traditions. It requires courageous management practices and leadership qualities to instill such habits.

The HSE (Health, Safety & Environment) department in companies will become the focus of attention for the revamping exercise within the organization. Passionate individuals with a sound understanding of the situation and its requirements will be the need of the hour. Senior management will need to consistently guide the team in ensuring a swift transition while striving to excel on performance standards in the required metrics.

Companies will need to hire specialist professionals and set up a dedicated function, which will monitor the relevant parameters internally. Since certain parameters are difficult to track with the present technology, they have been kept as voluntary disclosures. Consequently, it makes sense for companies to invest in R&D and develop technologies to monitor and report performance on such parameters. Such actions will not only boost their reputation among stakeholders but also keep them ahead of the competition.

What lies ahead?

It is not surprising to see that all the regulatory bodies in India are gradually picking up pace in enacting laws and guidelines in the field of ESG. Thus, it will be advisable for companies to be better prepared on the matter of sustainability. For some, this will be an opportunity to appeal to conscious consumers, improve their brand equity and make a deeper business impact while for others, this might be an opportunity to attract a wider gamut of global funds for investment.

The only thing to watch out for will be consumer acceptance as the guidelines will create upward pressure on prices, requiring them to bear the extra cost. It remains to be seen whether they will consider this as a necessity or just an extravagance.

Any views or opinions represented in this blog are personal and belong solely to the blog owner and do not represent those of people, institution or organizations that the owner may be associated with in professional capacity, unless explicitly stated.

Shiladitya Bhadury

Shiladitya has Consulting experience in the BPO Services & Chemical Domain, post his MBA from SPJIMR, Mumbai. Prior to his MBA, he had worked with BPCL for 3 years in the Retail business unit (retailing of petrol & diesel from petrol pumps). He is also a Mechanical Engineering graduate from Jadavpur University, Kolkata. He used to be a professional cricketer prior to taking up roles in the corporate sector.