The article discusses the challenges and recent developments in the Indian aviation sector. It highlights the bankruptcy of Go First and its impact on the industry, including potential opportunities for competitors. The article also mentions the growth potential of the Indian aviation sector, with increasing passenger volumes. Furthermore, it outlines the challenges faced by the sector, including volatile fuel costs, regulatory constraints, fierce competition, inefficient infrastructure, and seasonal demand fluctuations. The conclusion offers suggestions for addressing these challenges and promoting a sustainable aviation industry.

Introduction:

One of the fastest-growing industries in the worldwide market, the Indian aviation sector has seen substantial expansion in recent years. India has a sizable population and rising disposable incomes, which has caused the demand for air travel to soar. However, the industry is suffering from unsustainable debt, and rising expenses, due to which numerous airlines have either been grounded or forced to merge. A recent victim was Go First.

Go First Saga:

What led to the failure of Go First?

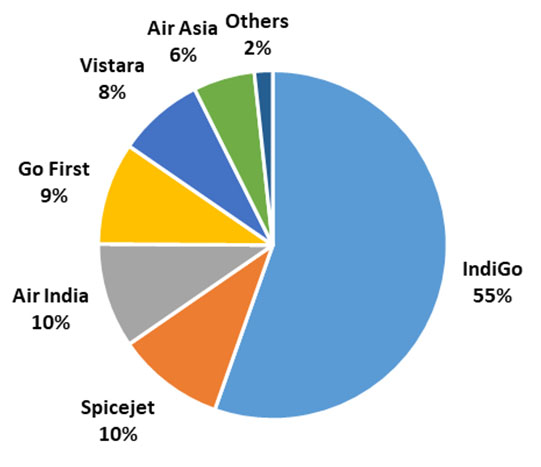

Despite having a significant presence in the domestic aviation industry Go First filed for bankruptcy owing to the grounding of over 45% of its fleet due to failed engines and a lack of spares provided by US engine manufacturer Pratt & Whitney. This led to a loss of $ 1.3 bn.

Source: Statista

Passenger airlines in India barely make a PAT of 0.5 to 1% even with their entire fleet being functional, so we can imagine the financial burden on Go First.

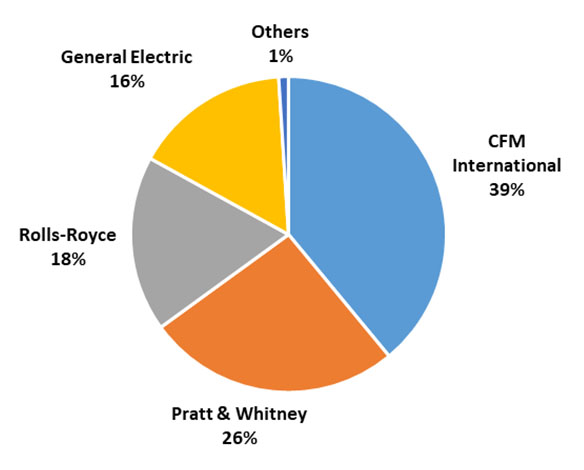

Why are airline companies choosing P&W despite being plagued by engine problems?

Pratt and Whitney’s engines are popular with airlines as the engines are said to be fuel efficient (saving up to 16% fuel), have low maintenance costs and the company offers attractive deals to customers.

Source: Statista

Impact of Go First insolvency on the Indian aviation industry:

- The Go First situation may make it easier for competitors like IndiGo, Air India, SpiceJet, and newcomers like Akasa Air to get a bigger chunk of the market

- Customers are at a loss because, in the coming months, airfares are anticipated to increase significantly with fewer players dominating the industry

- On June 6th, the minister of civil aviation presided over a high-level meeting with the airline advisory group and urged airlines to come up with a plan to ensure affordable fares amid an increase in ticket costs, particularly on certain routes that were earlier served by Go First

Indian aviation sector potential:

- In the next ten years, India is anticipated to overtake China and the United States to become the largest civil aviation market in the world in terms of passenger volume according to International Air Transport Association

- India’s aviation sector has seen substantial expansion, with domestic passenger traffic expanding at a CAGR of roughly 14.5% over the last six years

- In the first quarter of 2023, domestic airlines transported over 37.5 million passengers, an increase of 51.7% from the same period last year

- According to CAPA Centre for Aviation, India’s current domestic aviation traffic of 144 million is expected to soar to 350 million passengers by 2030

- However, India’s per capita penetration of domestic air travel (Domestic air passengers/Total population: 0.13) according to the world bank remains much lower than that of nations such as China (0.49), and Brazil (0.57), showing unrealized potential

Indian aviation sector challenges:

- Volatile fuel costs:

Aviation Turbine Fuel (ATF) used to cost ₹ 46 per gallon in April-2020, but it has now skyrocketed to ₹ 220 per gallon in March-2023. International oil prices are influenced by a wide range of circumstances such as geopolitical events, supply-demand dynamics, and economic conditions leading to significant volatility in oil prices which can often ruin an airline’s success.

Furthermore, value-added tax (VAT), which may be as high as 30%, is levied on ATF by the states. The only option to lower ATF costs and stabilize the aviation industry is to lower taxes because 85% of India’s oil needs are satisfied through imports.

- Regulatory Constraints:

The government controls the allotment of airport routes and slots. Airlines may have constraints on the routes they may run or the number of flights they can arrange in specific instances. This has the potential to hinder their capacity to extend their network and meet passenger demand. If an airline is unable to acquire profitable routes or enough slots at major airports, its growth prospects and financial viability may suffer.

- Fierce competition and pricing wars:

Low-cost carriers (LCCs) often employ a low-cost business strategy that emphasizes cost-effectiveness and basic offerings. This has exacerbated price competition as full-service airlines compete to maintain their market share by matching or undercutting LCCs’ rates thereby decreasing the margins of airlines.

- Inefficient infrastructure:

Due to the tremendous development of air travel in India, several airports are experiencing congestion. The present infrastructure is struggling to keep up with the growing number of flights and passengers. Congestion causes take-off and landing delays, leading to increased fuel consumption, personnel expenses, and operational inefficiencies.

- Seasonal demand and cyclicity:

Seasonal demand and the cyclical nature of the Indian aviation business might result in lower earnings for airlines. Passenger demand fluctuates throughout the year, with peak seasons characterized by high passenger traffic and vice versa. Airlines may experience significant competition and pressure to cut rates during busy seasons, lowering profit margins. In contrast, during off-peak seasons, airlines may struggle to fill seats, resulting in underutilized capacity and higher per-passenger expenses.

Conclusion:

The airline industry is competitive, and not everyone can succeed. The failure of airlines in India can be attributed to a combination of intense competition, high operating costs, regulatory challenges, and macroeconomic factors.

To address these issues and promote a more sustainable aviation industry the following measures can be followed:

- Reducing the VAT on aviation fuel by state governments as its price contributes to 45% of an airline’s overall operating costs.

- Streamlining the regulatory environment for India’s aviation industry. Government should act as a facilitator rather than a regulator, encouraging greater transparency with industry stakeholders.

- Developing infrastructure to improve regional connectivity by building new airports and transforming existing ones.

- Utilising advanced analytics to predict demand with accuracy can help businesses better understand the market and develop a competitive pricing plan in response.

- Stakeholders, including the government, airlines, and regulatory bodies, must collaborate to create a conducive environment for growth and address the underlying challenges facing the sector.

Sriharshavardhan Doppalapudi

Sri Harshavardhan is a management consultant who has worked with clients across various industries on projects that include Performance Improvement, Project Management, Mergers and Acquisitions, Market Sizing, Market Entry and Diversification Strategy. Prior to consulting, he gained experience in the steel industry, where he participated in the commissioning of a Steel Melting Shop project. He was also engaged in the construction sector, contributing to the development of ERP modules.