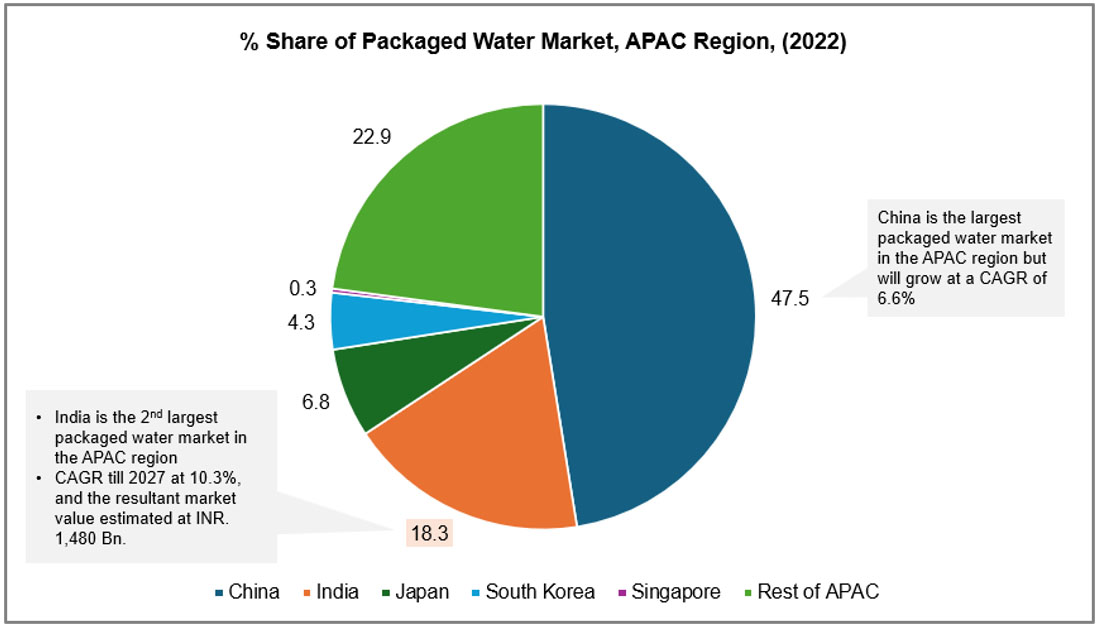

As per MarketLine, India’s packaged water market in 2022 was ~INR 905 Bn. The market is further estimated to grow at a CAGR of 10.3% to ~INR 1,480 Bn, till 2027. With a share of ~18% by value in 2022 in the APAC region, India is the 2nd largest and one of the fastest growing packaged water markets in the region, surpassing even China with respect to the forecasted growth rates.

Source: Packaged Water Market in India, October 2023, MarketLine

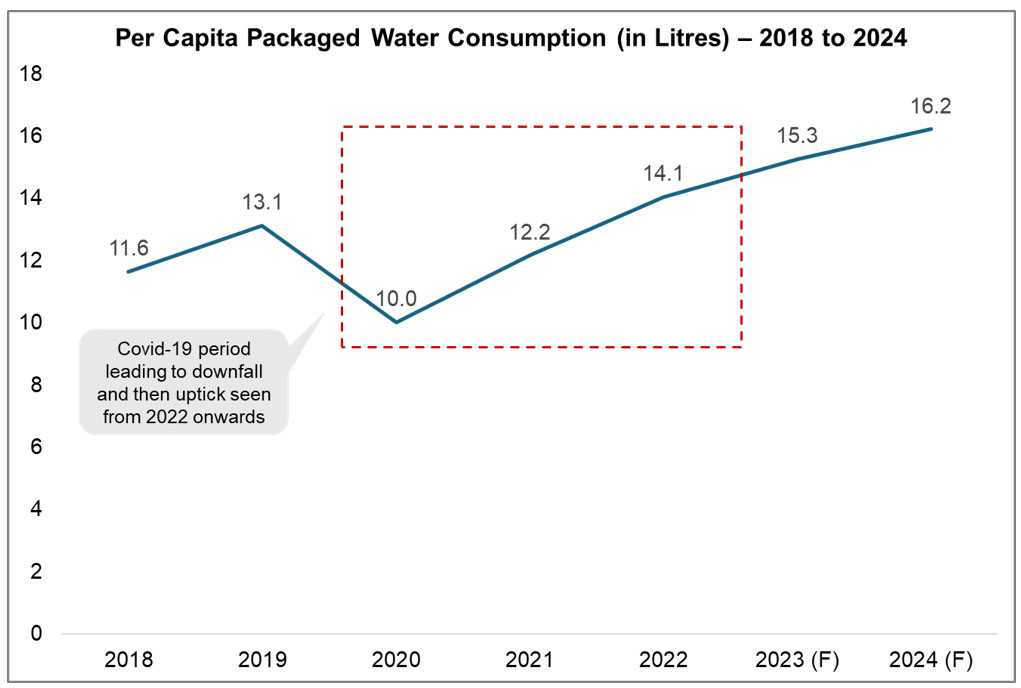

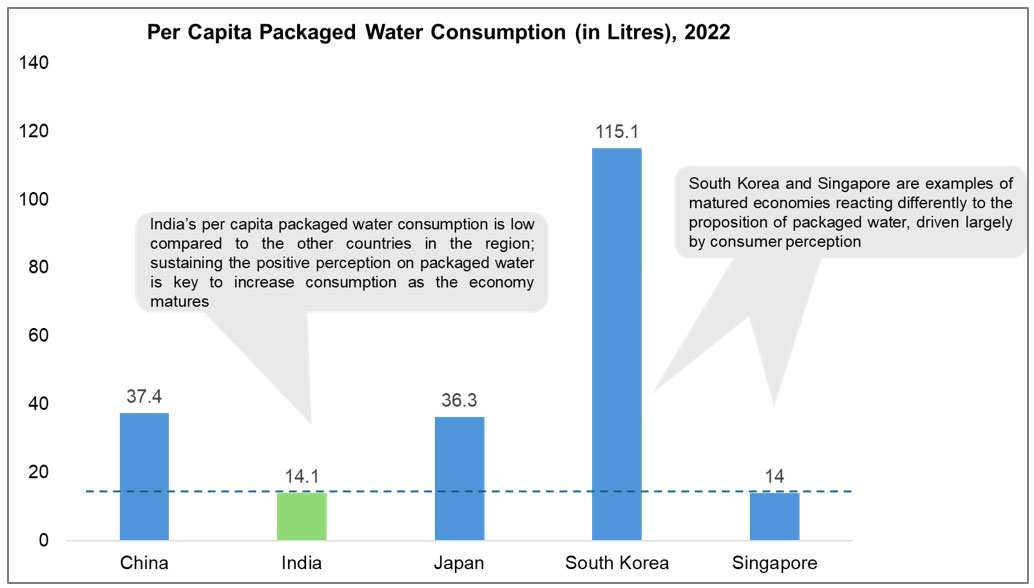

The key driver for this trend is India’s rapid economic growth leading to rising number of corporate offices, increasing demand for MICE events and increasing end-consumer demand driven by rising disposable incomes, see graphs below for India’s per capita packaged water consumption trends and benchmarking with other countries.

Source: a) Packaged Water Market in India, MarketLine b) UN Population Division Portal

Source: a) Packaged Water Market of China, Japan, South Korea, Singapore and India, MarketLine b) UN Population Division Portal

Still, the share of packaged water within the overall drinking water consumed in India is very low. Assuming India’s population at 1.4 Bn. and average per capita drinking water requirement at 3 litres per day, the packaged water’s average share of the overall drinking water consumed would be ~1.5%.

From the outset, the future of the Indian packaged water market looks promising, but there are several challenges that persist today that may hinder its growth. These are as listed below:

- Too many players in a small market: Post Covid-19, there has been a general shift towards healthy consumption, with this trend seen especially amongst urban consumers. The marketing by prominent packaged water brands has been revolving around the theme of “healthy and hygienic bottled water”, thereby resonating well with these consumers. However, ~200 brands operate in this space in India and ~75% of the share by volume of packaged water consumed is dominated by small players. These small players have not been able to build the same amount of brand equity as built by their prominent peers, thereby leading to a pullback on the potential sales and therefore the market’s growth.

- Price sensitive market: Even with positive brand equity, other challenge is the average price per litre of packaged drinking water in the range of INR. 15-20 currently. While the price figure may look small, based on the household consumption expenditure survey for 2022-23, the average per day expenditures per capita in urban and rural areas are INR. 215 and INR. 125 respectively. Further, ~60% of the urban and the rural population spends less than their respective average per day per capita expenditures. With the expenditure basket consisting of essentials such as food, medical, conveyance, electricity, etc. the spending on packaged drinking water is far-fetched for a significant portion of the Indian population, let alone for the niche ones such as the packaged “natural spring mineral” water.

- Lacking awareness on multiple product offerings: While many of the consumers would perceive packaged drinking water positively over the tap water suited for drinking, citing purity and health-friendliness, an average consumer might not be able to do so between packaged drinking water and packaged natural spring mineral water, even if sold by a leading player. Also, an average consumer is generally unaware of the nutritional benefits of these packaged products in terms of intake of calcium, magnesium, etc.

Today, Indian packaged water market stands at a juncture where strategic moves by its players can put it on an extremely, fast-paced growth trajectory. These are as listed below:

- Enhanced focus on B2B sales: The main distribution channel in the market is through on-trade outlets, however retailers lack the brand loyalty in this market due to low switching costs for the customers. Thus, the companies can focus on strengthening their distribution network through partnerships with institutional buyers like hotels, restaurants, corporate offices, and educational institutions, which have a high and a consistent water consumption. Heavy focus on bulk supply agreements along with volume discounts can attract such customers. B2B sales also give opportunities to push niche products such as natural spring mineral water and therefore capture high margins.

- Targeted promotion of niche products: Certain Indian companies offer natural spring mineral water bottled directly from ‘Himalayas’ and ‘Aravalis’. Highlighting the unique sourcing and superior quality of such products appeals to the premium consumer group. However, targeted promotional campaigns across the touchpoints of these customers are the key viz. premium hotels, malls, social media, etc., which thereby would lead to sales of high margin products.

- Scale-up through mergers and acquisition – Today, multiple players exist, especially the regional ones, leading towards challenges in achieving benefits of scale through demand, especially for natural spring mineral water where logistics is a major cost. Acquisition of regional players would give big players the scale, along with making packaged water more affordable, and also relieving consumer trust deficit on quality and hygiene. Regional mergers or partnerships can also lead to similar benefits. These benefits will create a virtuous demand cycle as the different target segments would also come into the fold, such as the ones with less purchasing power.

- “Incubate” streams of ideas – Incubating new business concepts, piloting and roll-out/roll-off can be one of the diversification pathways beyond packaged water. For example, “mineral dosing” and “real time water quality monitoring” – already part of the packaged water production line – are some of the “services” that the players can plug out and evaluate for offering in the B2B format. Another huge opportunity area is replacing PET packaging of bottles with biodegradable packaging – still in its infancy. This is especially relevant as consumer participation is very critical for a successful recycle-to-reuse ecosystem, and the current levels of consumer participation in India in such initiatives are very low owing to the awareness challenge.

Favourable conditions and regulations position India’s packaged water market for an exponential growth phase. “Early movers” will dominate, grow alongside as the market evolves and will shape its future as well!