This article is the Part-2 of the previous article “Look Beyond India for EV Opportunity (Part 1)”. The previous article has analysed booming 2W EV market in India, from the future demand-supply aspects and established the need for Indian OEMs to expand globally for their growth. Current article elaborates key areas which need to be evaluated by OEMs while entering the global markets.

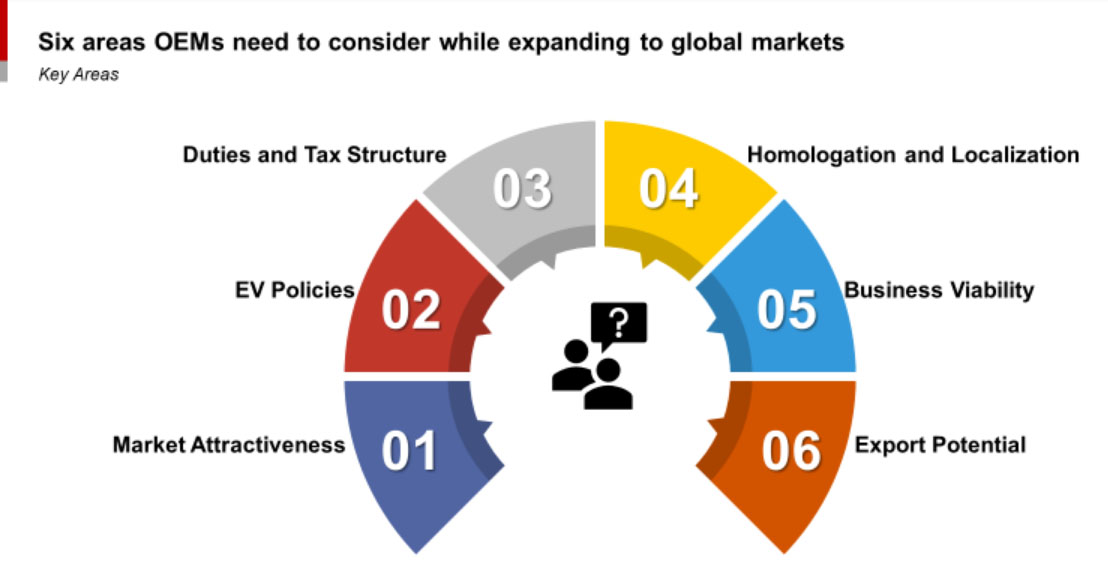

Look Beyond India for EV Opportunity: Six areas OEMs need to consider while expanding to global markets

In my previous article “Look Beyond India for EV Opportunity (Part 1)”, I have discussed about the potential oversupply scenario in Indian 2W EV market and established the need for Indian OEMs to enter global markets. While identifying the target country is the first piece of the entire puzzle, the other one is the answer for the question “How to enter the target country?”.

In this context, current article takes you through a set of six areas (apart from having a suitable product for the market) the OEMs need to consider while entering global markets.

Market Attractiveness: The market attractiveness parameter is the most significant while entering any international market. OEMs need to evaluate attractiveness both in near-term and long-term perspective. OEMs need to keep an eye on certain markets which are not sizable and attractive now but might turn attractive in long-term considering the growth and penetration. Hence, OEMs need to evaluate following points.

- What is the current 2W market size?

- What is the current penetration of EVs and future prospects?

- How does the competitive landscape look like?

- What is the addressable market size in near-term and long-term?

- What is the pricing structure and potential net realization?

EV Policies: In general, globally the EV policies have been encouraging over the past few years. However, OEMs need to comprehensively evaluate country specific policies. OEMs should look at the policies from the perspective of entire value chain – end customers, domestic OEMs, importers, players in charging infrastructure space, and suppliers. The maturity of policies could be low in certain countries for which one can consider the potential future path.

Duties and Tax Structure: For the OEMs which are planning to export from India, duty structure plays a pivotal role. This would also define if the exports needed to be in CKD (Completely Knocked Down) or SKD (Semi Knocked Down) format as the duty can differ. Additionally, OEMs need to evaluate the duty structure specific to EVs and their spares as well. Similarly, the local taxes play a crucial role for the overall operations. It also affects the final prices to the end-customer.

Homologation and Localization: Homologation is the process of certifying that a particular vehicle is roadworthy and matches certain criteria laid out by the local government for all vehicles made or imported into that country. The criteria would cover multiple aspects such as – emission norms, safety norms, roadworthiness etc. as per the local regulatory agency. The stringency of homologation would differ from country to country – both in terms of rules / regulations and timeline. Hence, it is necessary to evaluate these norms and design / manufacture the vehicle accordingly.

Similarly, many countries with modest local manufacturing ecosystem have norms related to localization. These norms are mainly for generating employment for the locals and for the benefit of local businesses. While this could be a benefit for the host country, it would be a challenge for the Indian OEMs – mainly to develop the local suppliers, establishing facilities etc. Hence, it is necessary to evaluate these norms and design / manufacture the product accordingly.

Business Viability: Considering the above four points in detail, OEMs need to evaluate their business viability. In the short-run, the focus can be on the volumes, market share and the topline; but in the long-run, they need to keep an eye on metrics such as growth, ROCE / IRR. These metrics could pose a threat for new-age-startups which are heavily funded by investors expecting returns; but the legacy OEMs can sustain even with not-so-good-looking metrics for few more years with their deep pockets.

Export Potential: In the short-run, OEMs would be benefited exporting directly from India (in CKD / SKD form). But once the brand garnered traction and volumes reached a threshold, it would be better to establish a local assembling / manufacturing facility. This would be beneficial in multiple aspects for OEM. However, even before entering the target market (via direct exports from India), it would be worthwhile to take a long-term view and evaluate the potential for exports from the target country with local setup. The export potential would depend on multiple factors such as – FTA agreements, geopolitical factors, marked conditions, manufacturing / export incentives etc., which should be evaluated by the OEMs.

To conclude, the OEMs need to look beyond the product and its specifications while entering the international markets. They not only need to consider the market attractiveness, EV policies and business plan, but need to also look at the local norms, regulations which can potentially impact the overall business viability.

Ramesh Babu M

Ramesh has 6 years of experience across automotive, agribusiness and oil & gas sectors. As a consultant he has supported multiple Indian auto OEMs through various engagements. Prior to consulting, he has worked with Bajaj Auto and Reliance Industries. He is a graduate of IIT Madras and IIM Kozhikode. He enjoys long-distance-running and playing badminton.