Sounak Chatterjee, Senior Consultant at Avalon Consulting provides insights on the evolution of banking sector, particularly about the open banking system. Furthermore, he also discusses the benefits of such a system and how it functions.

Introduction

The trigger point was in 2015, when European Banking Authority (EBA) came out with Revised Payment Service Directive PSD2. Immediately after this, countries around the world realized its potential and rushed to implement it. One year later, UK’s Competition and Markets Authority launched a special project involving its largest current account providers to open their account APIs. That same year, India launched the pilot version of UPI system. By 2018, countries like USA, Australia, Japan, Singapore, Mexico, Canada, New Zealand and South Africa had jumped into this revolutionary idea which was taking the banking industry by storm. This revolutionary idea was “Open Banking”.

Open banking is the next phase of evolution of the banking industry. Why? Let’s say Gabbar Singh works in an MNC after realizing robbing isn’t that lucrative anymore. Gabbar has a salary account, an education loan account (yes he did MBA), one personal bank account and one joint account with his wife Basanti. Gabbar also wants to save tax so he has a PPF account, NPS account and ELSS mutual fund units. He has life insurance and medical insurance. He also invests extensively in mutual funds. Managing so many accounts is a painstaking process and Gabbar has to log in into each and every app to get an idea of his consolidated financial status. Filing tax returns is another mountain to climb. One day, a kindhearted man named Thakur came and told him to install a “super app” which will solve all his financial tensions. Gabbar did and he saw this “super app” consolidates data from all the financial accounts/ services he is availing in a single window. He could even open/close bank accounts, buy/sell mutual fund units, buy insurance, take loans from banks his great-grandfather was also not associated with. This flexibility is Open Banking.

Definition

Open banking is a system in which third-party providers are given access to a financial institution’s customer account data with the customer’s permission. Customers can share their financial data with other suppliers, such as fintech firms, to gain access to new and innovative financial products and services. To securely share account data, it is often implemented through application programming interfaces (APIs). The goal of open banking is to improve competition in the financial sector and provide customers with more control over their financial data. Open banking will result in the following:

Increased competition

Because open banking allows new firms, particularly fintechs, to offer goods and services that can compete with existing banks, competition in the financial sector will increase

Customers will have more options

Open banking will provide them greater control over their financial data and will allow them to access a broader selection of financial goods and services from other sources

Growth of Fintech / Third-party providers

Open banking will allow third-party providers to have access to consumer account data and utilise it to create new and creative financial products.

How does open banking work?

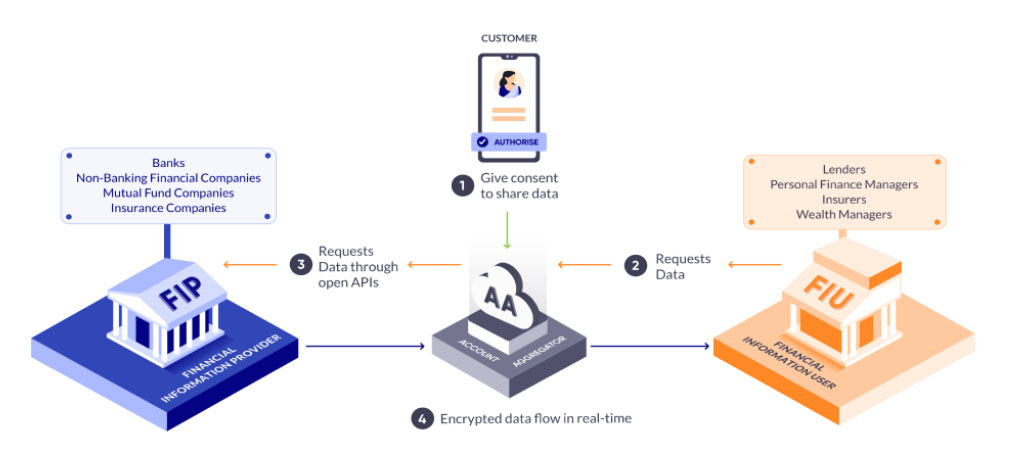

Look at the below picture by Sahamati (a non-profit industry alliance of Indian Open banking participants)

main participants of the ecosystem are the Account Aggregator (AA), the Financial Information Provider (FIP) and the Financial Information User (FIU) working together to simplify the process of sharing data.

- Account Aggregator – Account Aggregators (AA) use technology to let you share data between financial institutions such as banks, insurance companies, and mutual fund providers in an easy and secure manner. This information will not be shared without your permission. When a consumer grants permission to an Account Aggregator (AA), it collects your digital financial data from one or more accounts and distributes it to the financial institution that provides you with services such as a loan or insurance. In India, AAs were created through an inter-regulatory decision by Reserve Bank of India (RBI), Pension Fund Regulatory and Development Authority (PFRDA), Securities and Exchange Board of India (SEBI), Insurance Regulatory and Development Authority (IRDAI) and Financial Stability Development Council (FSDC).

- Financial Information Provider – They are the banks, NBFCs, insurance companies and asset management companies you have accounts with.

- Financial Information Users – receive digitally signed data from Financial Information Providers (FIP) via Account Aggregators. FIU use the data to provide various services to the consumer like loans, insurance, or wealth management.

- Technology Service Providers – work with FIUs and FIPs to provide AA goods and services. They create foundation modules that connect the FIP and FIU modules to the ecosystem’s Account Aggregators. TSPs can also assist financial products in areas like as under-writing models, SME Scorecards, app product design, and more.

Open Banking in India

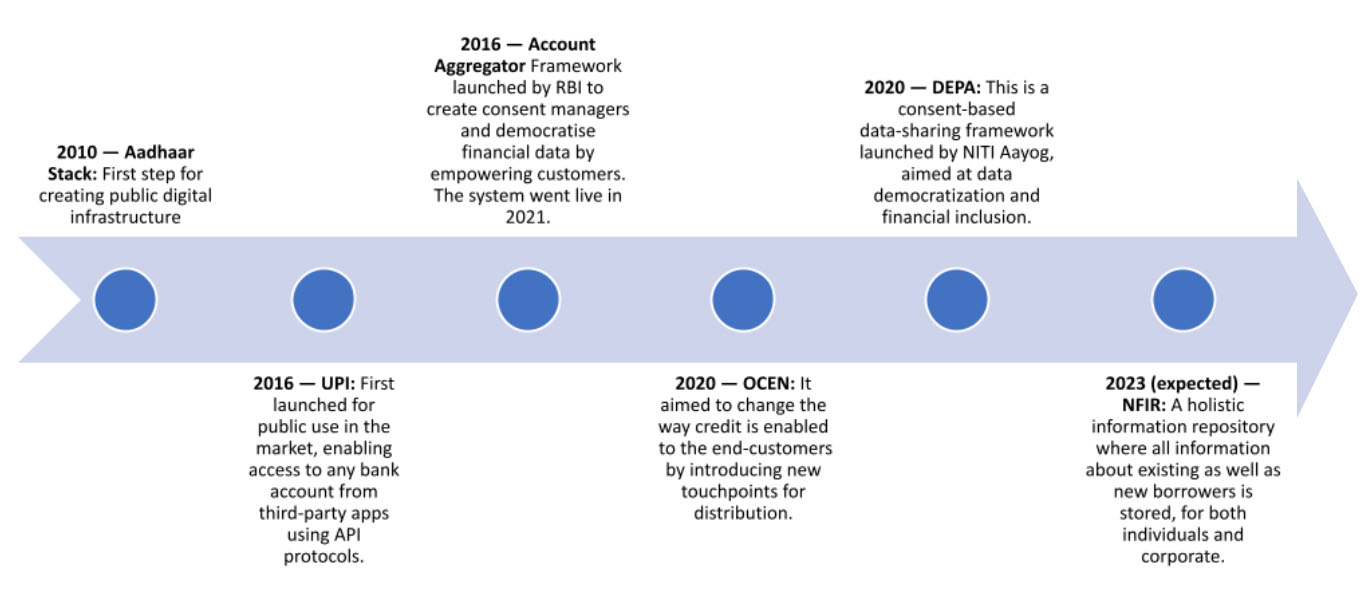

India is accelerating rapidly into Open banking implementation. The seeds were sown in 2010 with the launch of AADHAAR. Since then, steady steps have been taken in terms of Account Aggregator framework, launch of APIs of financial institutions to framework for credit democratization. As per IMF, India’s Open banking policies, popularly known as the “India Stack” is different from other data policy frameworks implemented around the world due to its vast public digital infrastructures and protocols.

As of February 2023, India has 9 AAs with operating license and 8 AAs with in-principle approval. Along with this there are 31 FIPs who have created APIs to access their account information, 27 of which are banks and 4 are insurers. 77 other entities are currently evaluating / testing FIP modules. The majority of players in the system, however, belong to FIUs, which are 143 in number, 77 of which are NBFCs, 30 are banks are 11 are insurers. 140 entities are currently evaluating / testing FIU modules.

As we can see, Open banking is the new face of the banking industry and although there have been quite a few improvements in this space, there are miles to go before it is fully unleashed. This begs the following questions:

- What will be the use cases of open banking?

- Which sectors will get disrupted as a result?

- What should be the strategy of the incumbents in this phase of heightened competition and flexibility?

- What are the implications for customers like us and what risks will we be exposed to?

We will tackle all these questions in the next blog. Stay tuned.

Sounak Chatterjee

Management consultant experienced in business model development, GTM strategy, market due diligence, channel strategy across multiple industries like Automotive, Durables, FMCG and Agribusiness.