Social commerce blends shopping with social media, revolutionizing online retail by integrating discovery, engagement, and seamless transactions. With India’s expanding digital audience and rural market potential, brands can leverage influencers, user-generated content, and community-driven experiences to thrive in this growing sector. As it matures, social commerce promises to redefine e-commerce by prioritizing interaction and personalization.

India Story

Between 2015 and 2020, smartphone usage in India grew more than fivefold, while data charges became significantly more affordable. During the pandemic, social media adoption surged, with Indian users becoming a major segment of the global audience. By 2022, India had 658 million internet users, making it a prime target for platform expansion.

Sunita, from Rampur in Bihar, exemplifies this shift. Previously focused on family and household chores, her life now revolves around her smartphone and free 5G connectivity. She explores recipes on YouTube and stays connected through Facebook and WhatsApp, reflecting the broader trend of millions of Indians embracing the internet.

Currently valued at $1.5-2 billion, social commerce in India has considerable growth potential. With support from smaller towns and the entry of major players like Reliance and Tata Group, social commerce is set to become mainstream, transforming the e-commerce landscape.

What is Social Commerce?

Imagine scrolling through your phone, spotting your favourite influencer in a stylish t-shirt from a new brand. You love it, tap the photo, and quickly navigate to the product page on Instagram. With just a few clicks and facial recognition for payment, you’ve made a seamless, socially driven purchase.

Social commerce integrates the entire shopping experience directly on social media platforms, from product discovery to checkout. According to IMARC, the global social commerce market hit $995 billion in 2023 and is set to reach $6,800 billion by 2032. With 4.9 billion social media users as of June 2023, expected to grow to 5.85 billion by 2027, these rising figures are fueling social commerce’s rapid expansion.

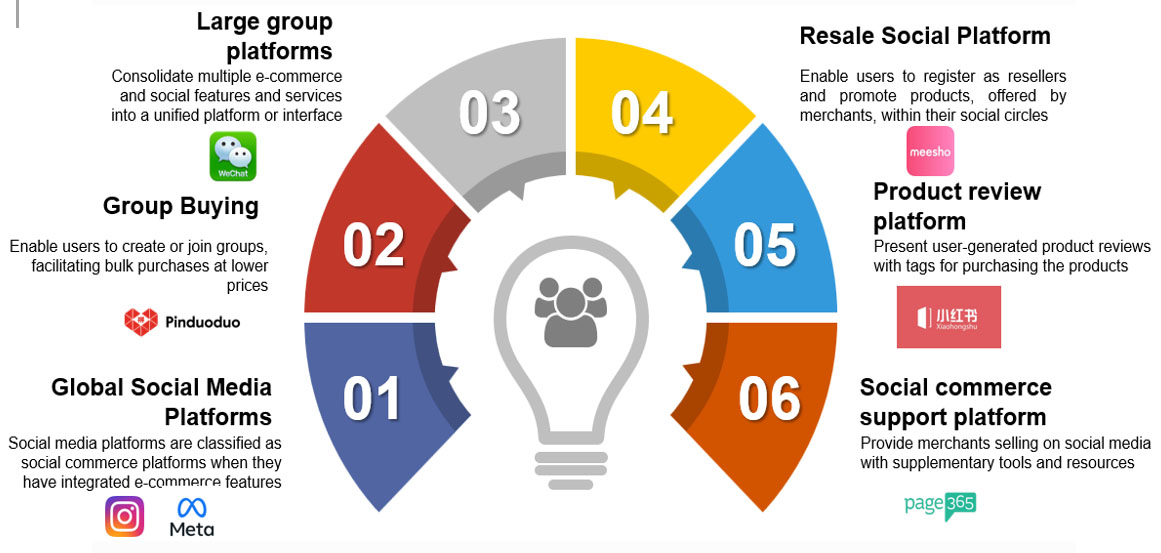

Social Commerce Universe

Traditional e-commerce and social media platforms are now coming together in social commerce, leading to noticeable service differences. A landscape analysis revealed six distinctions. Social commerce players can be either “intermediaries” or “super apps.” Intermediaries connect users to other e-commerce or social media platforms. Super apps bring together different social and e-commerce features, like buying, selling, and chatting, all in one place

| Intermediaries Platforms | Super App Platforms |

| Global Social Media Platforms | Product Review Platforms |

| Group Buying Platforms | Social Commerce Support Platforms |

| Resale Social Platforms | Large Group Platforms |

Who are the customers and merchants of social commerce:

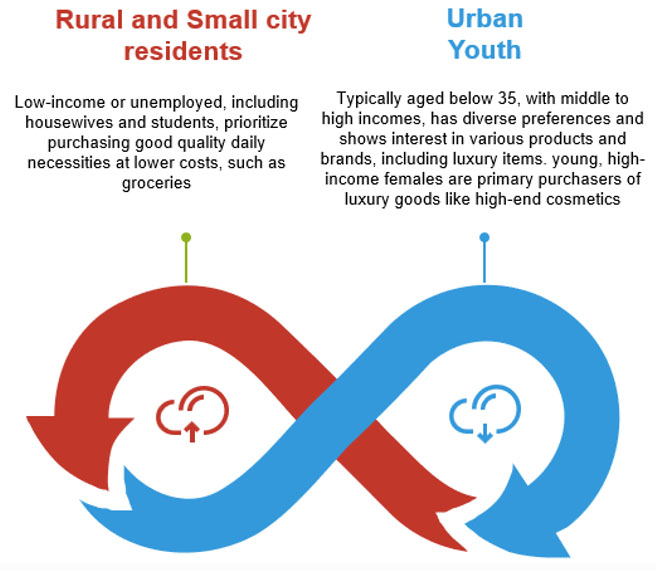

Our analysis identifies two key customer profiles and four distinct merchant profiles

Merchant profiles in social commerce vary widely. Small businesses and individuals use social commerce to increase visibility, reach new audiences, and boost sales, often making it a primary or supplementary income source. Social resellers, such as influencers, sell products from other merchants on social media, generating income and expanding their influence. This group often includes homemakers, students, or bloggers. Medium-to-large brands use social commerce to expand into new markets, including rural areas, by leveraging their strong online presence and loyal customer base.

Key Features and Growth Drivers

Social commerce enhances platform e-commerce by addressing diverse consumer needs, including greater product variety and personalization, community connection and reliability, shopping convenience, and engaging experiences. It provides small and medium-sized businesses with an accessible way to establish an online presence and gain visibility, with many now using platforms like Facebook, Instagram, and WhatsApp reseller groups to reach social media buyers.

What can brands do?

To effectively leverage social commerce, brands should focus on several key strategies. Building user trust is essential, as credibility can be established through transparent practices; for example, Nykaa enhances consumer confidence by utilizing product reviews and ratings. Ensuring a seamless customer journey is also crucial, with smooth transitions from product discovery to purchase, as seen with Instagram integrations and user-friendly apps like Myntra, which offer various payment options. Prioritizing experiential engagement is important as well, with interactive experiences like Shein’s live shopping events on TikTok and Meesho’s social media contests. Fostering online communities allows customers to connect and share, exemplified by DealShare’s use of gamification and Gymshark’s active Facebook group for workout discussions. Empowering users and leveraging influencers can inspire user-generated content, with Myntra collaborating with fashion micro-influencers to set trends. Optimizing product assortment through data-driven selections, as Shein does, and tailoring pricing strategies, such as DealShare’s group buying discounts, are vital for meeting consumer demands. Brands must also adapt to buying trends, updating products and marketing efforts frequently, as practiced by Shein and Nykaa. Establishing a social commerce-ready supply chain, like Myntra’s integration with Flipkart’s network, ensures efficient logistics and fulfilment. Finally, implementing a cohesive strategy that aligns content and promotions across platforms, with tailored approaches for each platform’s behavior, as Meesho does with personalized recommendations on WhatsApp and Facebook, is essential for success in social commerce.

Future/Outlook

The future of online shopping is shifting towards discovery-driven social commerce, emphasizing community and interaction over traditional search-based e-commerce. Social commerce offers a seamless and innovative shopping experience for consumers, new revenue opportunities for tech platforms through brand partnerships, and deeper engagement for brands. While still emerging in India, it holds significant growth potential and could reshape the online consumer market as it evolves.

Sutesh Tiwari

Sutesh Tiwari is a Senior Consultant specializing in Go-to-Market Strategy, Performance Improvement, and Diversification Strategy, with 4+ years of diverse experience across sectors such as Chemicals, Manufacturing, and Media. His previous experience includes Digital Marketing Strategy for an FMCG major and Diversification and Go-to-Market Strategy for a chemical player. Sutesh is an MBA graduate from JBIMS, Mumbai.