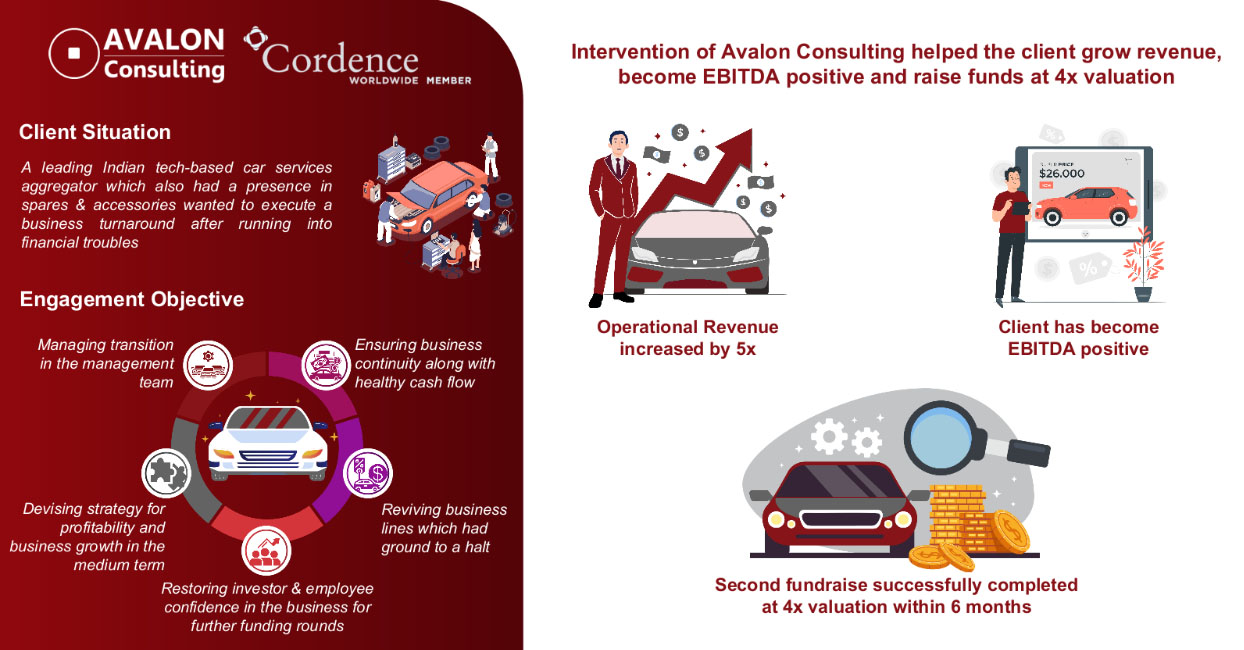

This case study highlights how Avalon helped drive growth-oriented restructuring in a leading technology enabled car service platform client.

The Client faced severe financial issues faced issues leading to shrinking primary revenue streams, poor cash flow, extensive debt outstanding, operational halt across multiple verticals, lack of structures and protocols and low employee and investor morale which led to recent acquisition of the firm by leading auto component maker.

Avalon stepped into the management team of the client organization and taking control of all aspects of the business and prepared a detailed business plan for the next 12 months. Avalon initiated drastic changes in the payment processes, organization structures and reporting procedures. Avalon took part in contract execution conversations, debt write-off negotiations and debt settlement processes. Avalon analysed and structured cash flows, initiated operational improvement, diagnosed customer experience and reviving crucial business lines.

The impact of these interventions led to:

- Restored confidence of early investors providing a 4x rise in firm valuations

- Operational revenue increased by 5x from the time of acquisition with EBITDA improvement of over 80%

- Converting the client to EBIDTA positive and on the path to a 4x revenue growth in the current FY

Loading...

Loading...